Survey questions for the recent COITM study

Survey questions for the recent COITM studyA new study conducted ahead of the China Outbound & Inbound Travel Market (COITM) 2026 reveals that China's vast outbound travel market is set for further growth in 2026.

This surge in growth may be attributed to the spread of visa-free policies for Chinese nationals and a stronger Chinese currency.

The said study was conducted to gain a deeper understanding of the insights from frontline industry practitioners, as well as the latest trends in the outbound tourism market for 2026 based on the preferences of the China outbound tour operators and travel agents.

3,000 industry outbound travel professionals from the COITM database, as well as 15 other professionals were selected for research samples, and a survey questionnaire was distributed via two channels: email and WeChat.

A total of 310 valid questionnaires were collected throughout the week-long research period.

On Wednesday, 28th January, COITM founder and executive director Qinghui Qing presented relevant highlights from the survey on an online seminar conducted with Dragon Trail International under the theme Working with the Chinese Travel Trade in 2026.

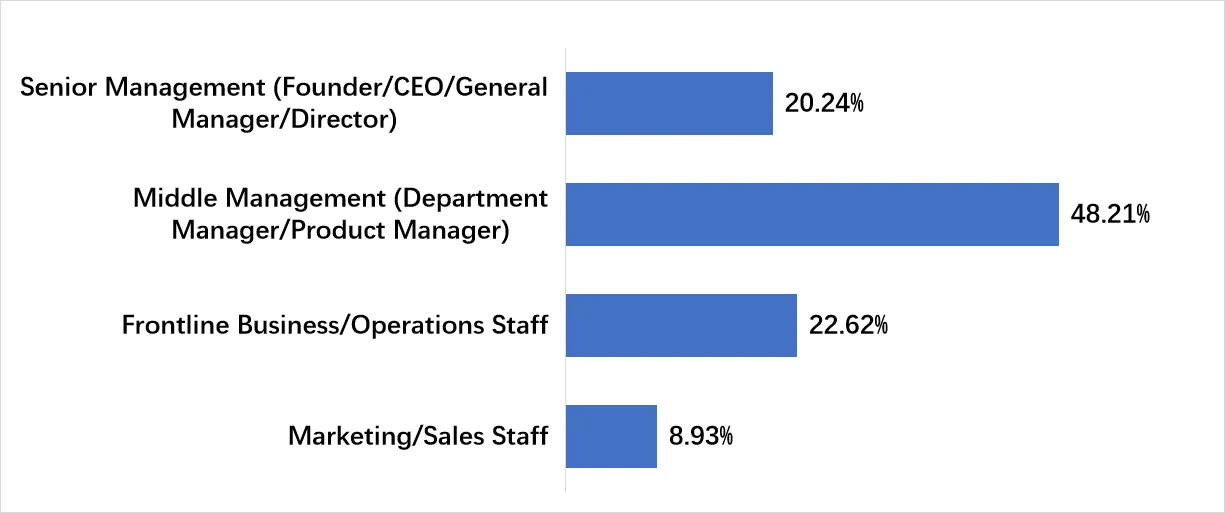

Relevant demographics

Who participated in the survey

Participants based on their roles

Survey findings

With regard to market forecasts, around 14 percent of respondents think the China outbound travel market will grow by over 20 percent.

On the other hand, 33 percent opined that the growth will range between ten and 20 percent.

46 percent think that market recovery will remain steady, rising by around ten percent as it moves closer to levels last seen in 2019.

As to who or what is driving market growth, over 75 percent of respondents believe that Gen Z’s push for personalised and in-depth travel experiences is one of the major factors.

However, 67 percent think that it is the silver travellers (those over the age of 60) who are pushing growth thanks to their wealth and the fact that they have the most time to travel.

It was interesting to note that almost 49 percent of respondents feel that the “new middle class,” essentially those out for quality travel experiences, are also fuelling the current growth surge in the market.

Where Chinese travellers are going and the products they’re interested in

Additional findings show that Southeast Asia, South Korea, Australia, and New Zealand will be the most popular destinations for the Chinese outbound travel sector this year.

South Asia will be next, and, quite interestingly, South America is currently ranked the third popular destination for Chinese travellers, followed by the Central and West Asia regions.

It should also be noted that the Middle East. Europe and North America are no longer listed at the top as they were a few years ago.

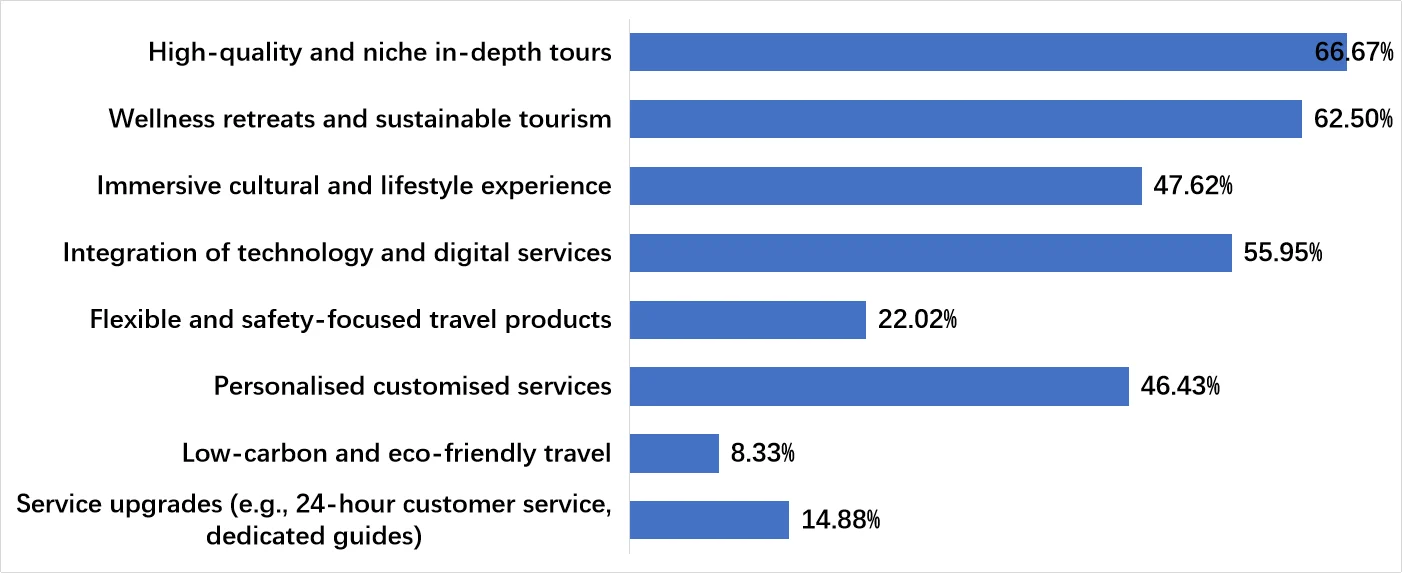

With regard to the types of products Chinese travellers will go for over the next three years, high-quality and niche-in-depth tours stand to become the most popular products, representing 66 percent of respondent preferences.

Wellness retreats come in second, accounting for 62 percent of survey responses.

Almost 56 percent of respondents also welcomed the integration of technology and digital products.

Respondents also expressed interest in immersive cultural and lifestyle experiences (47 percent) and personalised products (46 percent), as Chinese travellers continue to move beyond traditional tourism options, favouring high-value, tailored-made experiences.

Chinese outbound tour operators define the suppliers and partners they need

Furthermore, the survey discovered that theme-customised tourism suppliers are the most popular among respondents, accounting for nearly 68 percent of responses.

On the other hand, 44 percent and 42 percent of respondents are seeking attractions and economical accommodation suppliers.

This may possibly be driven by the growing number of free and independent travellers (FITs) and the younger generation’s growing demands.

It also can be seen that Chinese tour operators are also looking for MICE business suppliers and national tourism boards to work with, accounting for 38 percent and 32 percent respectively.

What the Chinese travel sector expects from COITM 2026

Based on feedback, around 72 percent of respondents expect COITM to build bridges between China travel professionals with overseas tourism boards and associations.

62 percent of them would like COITM to organise high-quality international scheduled B2B meetings.

Half of them would like the show to provide first-hand travel resources from overseas, while 43 percent want to see COITM to organise industry conferences and social networking.

Keeping all these in mind, it is important to note that COITM operates as a multi-pathway B2B platform, serving international destinations, hospitality groups, travel service providers, and professional travel buyers through three distinct engagement channels:

- China Travel Ecosystem Gateway Providing institutional trade exchange, industry dialogue, and cross-border market connectivity across China’s full travel value chain, including tourism, hospitality, aviation, destination marketing, and travel services.

- China Outbound Engagement Pathway Supporting global destinations, hospitality brands, and tourism organisations seeking to connect with Chinese outbound travel buyers, agencies, and distribution platforms through structured B2B matchmaking, partnership development, and market-entry frameworks.

- China Inbound Engagement Pathway Supporting international travel buyers, wholesalers, corporate travel planners, and tour operators seeking to connect with qualified Chinese suppliers to develop, distribute, and scale China travel products in global markets.

COITM will provide opportunities for both international and Chinese professionals, fostering an upgraded industry ecosystem, and driving tourism towards greater diversity, personalisation, and sustainability, and to delivering continuous value for the industry.

Click the buttons below for further information on COITM 2026: