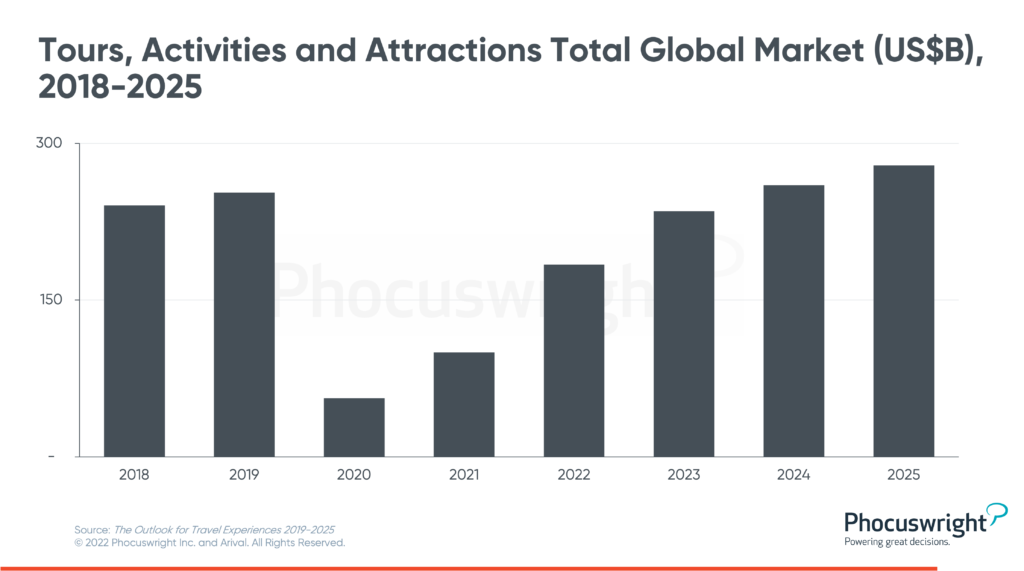

Post-pandemic changes in shopping and booking behaviour are fuelling a boom in the global tours, activities and attractions (TAA) industry. According to Phocuswright’s new joint travel research report with Arival, The Outlook for Travel Experiences 2019-2025, travel experiences represented USD253 billion in global gross ticket revenue in 2019, making it the third-largest sector of tourism after transportation and accommodation. TAA was the hardest-hit area of travel during the pandemic but has bounced back largely due to shifts in traveller behaviour.

“TAA has long been one of the largest and most important sectors in travel and tourism – and despite the heavy toll of the pandemic on operators worldwide, it has remained resilient in 2022,” said Eugene Ko, director of marketing and communications at Phocuswright. “As we look ahead to 2023, travellers are placing more of a focus on experiences and once-in-a-lifetime activities. They want to make up for time lost during the pandemic, seeing and experiencing as much as possible on their trips. While recovery across regions and segments is uneven, we believe TAA will be one of the biggest success stories of 2023 – and it’ll be one of the main focus areas at this month’s Phocuswright Conference in Phoenix, Arizona.”

Among the key findings of the report:

The TAA sector declined 78% in 2020, a far steeper decline than in other sectors of travel and tourism. Gross industry revenue will surpass 2019 by 2024, when global gross bookings will reach USD 260 billion. The recovery is very uneven. Certain regions, such as North America, and some sectors, such as outdoor activities, have rebounded much faster than other markets and segments. Online booking accelerated during the pandemic amid shifts in traveller behaviour and pandemic-related restrictions. Online channel share surged from 17% of gross bookings in 2019 to 29% by 2021. Operator websites - especially attractions - benefited significantly from pandemic-related shifts in traveller behaviour and will continue to grow through 2025. Offline direct bookings will regain some share in 2022-23 as some visitor behavior normalizes and groups and package tour travel returns, but online channels will continue to grow faster than the overall market. Online travel agencies, or OTAs, are the fastest growing channel, with gross bookings rising from just under USD 8 billion in 2019 to nearly USD 20 billion by 2025.