Private jets flying to exotic destinations, limos waiting at the airport, expensive dinners meetings in Ritz-Carlton Hotel restaurants, and of course hotel suites with the best view – according to the media, business travel rocks. Well, the foregoing may be the itinerary for top-shelf politicians and CEOs of global corporations, but for most employees, corporate travel doesn’t reek of luxury.

Besides, activity-packed business trips start way earlier, as you board a plane before dawn and end much later as you finally fall into bed after dark. They require preparation both for employees and managers, meticulous expense tracking, and often hours of manual reporting.

In addition, to comply with expense management policies, employees must store receipts and documents needed to fill in the report that has a limited time for submission, all according to strict company guidelines. And even if this policy is not clear enough, costs that are not properly documented, are costs that may not be reimbursed.

Travellers need to figure out what expenses can be reimbursed and the best way to track and transfer them. Considering how often business travellers follow the bleisure trend, things become even more complicated and harder to organize.

Organizations themselves don’t have a fun time approving trips and reimbursement claims. What is the best way to financially support an employee? Should they pay with their own money and then submit the receipts? Or should they be handed a corporate credit card so that management can track expenses? And if so, how will we track these expenses, and what will we do with this data later to generate relevant reports, predict future expenses, and wisely manage them?

Travel expense management (also often called TEM or T&E) is the element of corporate expense management that deals specifically with controlling business travel expenses. To decide how these expenses will be managed, organizations create a travel policy and expense policy to let employees know how much they can spend and on what.

TEM’s numerous goals include:

- Budgeting

- Expense control

- Booking

- Preventing disruptions

- Productivity control related to submitting, approving, and reimbursing expenses

- Financial reporting

- Negotiating with third-party vendors

- Duty-of-care support and assistance

GBTA (Global Business Travel Association) predicts that by 2020, worldwide corporate travel spend will reach $1.6 trillion or 25 percent more than in 2015. These spendings include flights, hotels, meals, rental cars, client entertainment, and conference fees. To avoid contributing to that massive increase, organizations are digitizing their TEM activities by adopting corporate travel software by off-the-shelf vendors and dedicated travel management companies.

Previously, we explored how technology trends advance the travel management ecosystem. In this article, we take a look at the current solutions available on the market and how they may benefit you. Depending on the size of your organization and on how many of your employees travel, you can find yourself in one of the common stages of travel management adoption. Let’s see how your company currently manages travel expense activities and pick the solution that will work best in your case.

Stages of Travel Management Adoption

Travel expense software automates the processes that you already have. It should simplify data input and review, decrease manual labour, and provide full visibility and transparency of the employee expense trail. Above that, an effective TEM solution will make cost-saving opportunities more apparent and will automatically control expense tracking.

Concur describes five stages of travel and expense management maturity. Let’s see what types of solutions fall under each category.

Stage 1: Excel- or paper-based reporting

Manual tracking tools are simple and familiar. But they’re also extremely error prone. For companies that are just starting to manage travel, Excel spreadsheets may work fine, but sooner or later, as you grow and your employees start to travel more regularly, you have to adopt a better approach to delegate routine activities to technology and allow managers spend their time more effectively.

Reportedly, 41 percent of business travellers surveyed by KDS still use spreadsheets to submit their expense data, and only 11 percent use online tools to directly input expenses on the go. People store their receipts in wallets and envelopes, and although most of them take expense tracking responsibly, they simply don’t know enough about existing solutions or their company’s policy to try something else.

What’s the business case for this solution?

- Your employees travel very rarely

- Your small team doesn’t have a travel manager

- You don’t have enough budget to spare yet

Stage 2: Enterprise Resource Planning (ERP) applications

ERP software helps organizations manage all of their business processes, including accounting. These solutions are not generic spreadsheets, but advanced tools allowing companies to automate financial operations and regulations. They can and do work for travel management, help with budgeting, reporting, and reimbursement, but their customization opportunities are limited. If your employees start travelling more often, you’ll soon notice the need for more travel-related functions and assigned stuff to handle them.

This also doesn’t diminish much of the manual labour that agents and employees have to do to collect paper receipts and add information to the system, and they also don’t allow for tracking expenses in real time. Tools from Microsoft Dynamics, Oracle, and other resource planning software are not wired for T&E and create unnecessary complications for travellers and agents alike.

What’s the business case for this solution?

- Your accounting staff effectively manages your infrequent business trips

- Only a small portion of your employees regularly travel and they’re confident with current policy and expense tracking

- As a transitional stage for cloud T&E solutions

Stage 3: Mobile-first/Cloud solutions

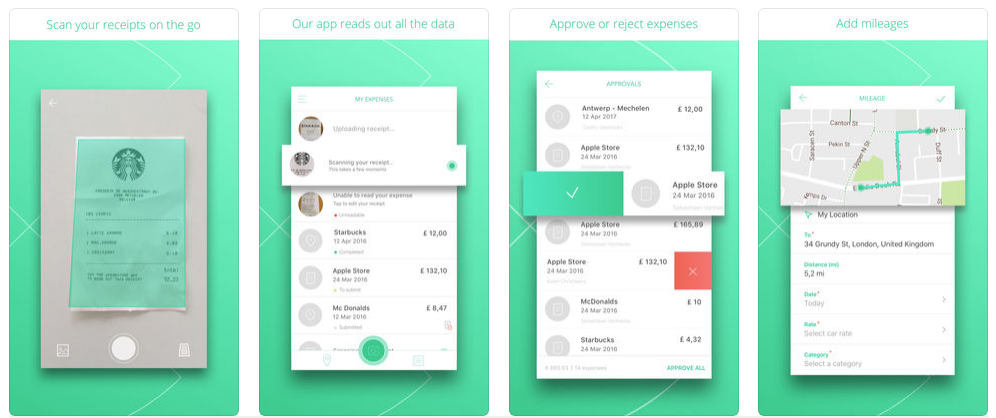

At this stage, travelling employees are enabled with specific mobile apps allowing them to capture receipt information with their smartphone camera, keep everything in one place, and automatically sync the data with a company’s expense record for the greatest transparency. Most of the existing corporate travel software falls under this category.

Solutions like Deem, Xpenditure, or Coupa Expense allow travellers to capture receipt data via photo, track mileage if they’re using a car, and integrate corporate credit cards.

Xpenditure mobile app

What’s the business case for this solution?

- A big portion of your employees travel regularly and often

- You have travel agents assigned to monitor, approve, and reimburse travel expenses

- Your travel policies are clear and available to all employees

- Your employees are comfortable with and receptive to using technology for expense tracking

Stage 4: Platform ecosystem

A better-developed approach would be using tools that provide more freedom to employees to manage different aspects of travel on their own. Today’s travellers are increasingly comfortable with making their own travel choices, and according to the KDS report, 37 percent of people book business trips via consumer-faced websites. The drawback is that most of the time their choices don’t comply with a company’s policies. Plus, this way they don’t make use of preferred supplier rates to get discounts for hotel rooms and flights.

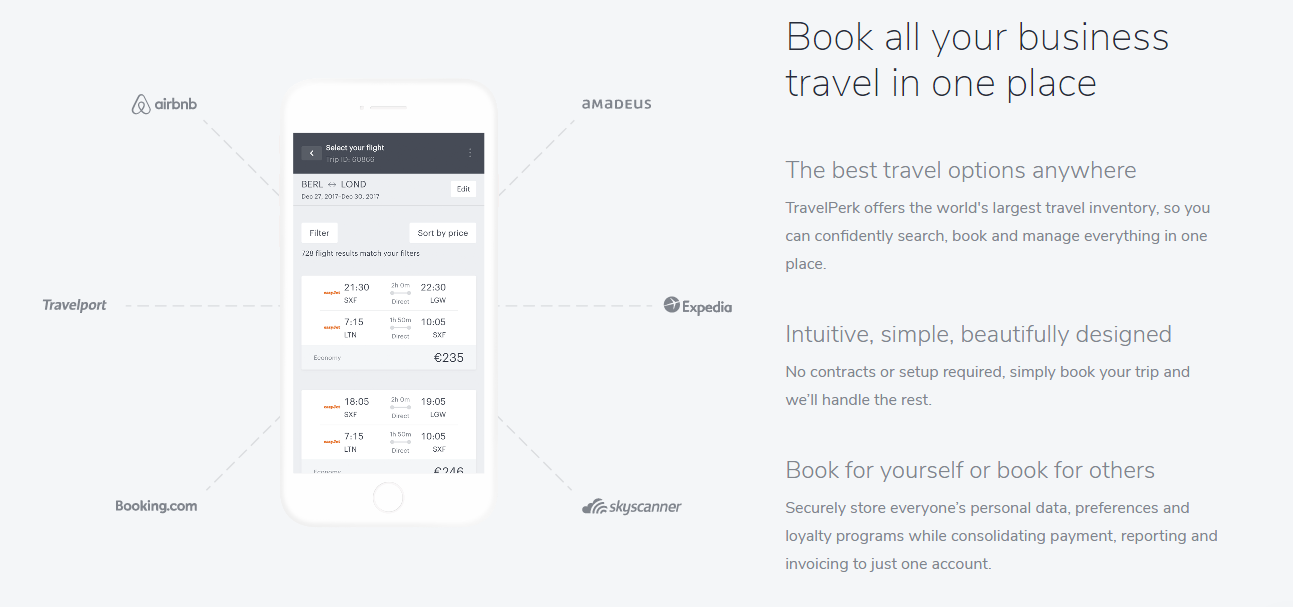

An all-encompassing ecosystem like the ones supplied by Concur, TravelPerk, or NexTravel allows employees to enjoy autonomy without sacrificing transparency.

TravelPerk is a tool for travellers and agents alike

What’s the business case for this solution?

- You have a lot of employees travelling regularly

- You practice self-service principles among your employees

- You’re already using third-party sales, IT, and accounting systems that can be integrated with the new technology

- You’re looking to automate your T&E activities and find opportunities for savings

- You have or plan to obtain special rates for flights and hotels from chosen suppliers

Stage 5: Predictive processes using advanced analytics

The final stage of TEM maturity implies benefiting from your company’s experience and predicting expenses before they even happen. Data-driven management, smart reporting, and machine learning capabilities help you make wiser decisions, see bottlenecks more clearly, and spend less time analyzing spreadsheets of data.

The solutions enabling AI, chatbots, or big data are still very limited. One of such examples is Fyle. It captures receipts from email, generates trends and statistics based on your spendings, and notices policy violations. Wipro Holmes is another tool that recognizes patterns in data to flag suspicious claims, reducing up to 15 days time usually spent on claim processing. Concur is exploring machine learning for various projects as well. ConcurLabs built prototypes for a Slack bot, an Alexa skill, and a sentiment analysis tool that analyzes user feedback. There’s still room for improvement but the future of corporate expense reporting is with AI.

What’s the business case for this solution?

- You have a lot of data that requires interpretation and analysis

- Your travel agents can’t keep up with claim processing and approving

- You need a tool to notice and react to employee fraud or policy violation

Custom systems for your specific goals, required technology, and integration needs

There can be various reasons why you might want to build a custom travel management system. For example:

- There aren’t enough analytics-driven services for you to choose from

- Popular solutions don’t offer integration with some of your systems and APIs, especially if they’re custom-made

- You need an all-in-one solution but don’t want to be saddled with a travel management company

- You don’t trust a provider’s data security policies

How to choose and integrate a travel expense management solution

Introducing a new solution to your tech ecosystem requires the collaboration of different departments. That’s why you have to prepare before embarking on a migration project. Here are our recommendations:

1. Define the problem(s) you want to solve

Typically, organizations face four main problems with their T&E efforts:

Confusing policies

Employees have a lot of stress associated with going on a business trip. To eliminate confusion, save time, and help prevent potential fraud, you need precise and accurately written policies with answers to most common questions.

Unstructured and non-transparent data

If you don’t use the travel data you have to plan future travels more effectively, then what’s the point? You should know the average sum of money an employee spends on food and transportation in different locations. You should track and be prepared for unexpected purchases. Your system needs to promptly generate relevant reports, easily compare datasets, and have a user-friendly dashboard to help travel agents access information at a glance.

Lack of automation

Paper receipts, badly organized Microsoft Excel spreadsheets, manual information input – all weaken the travel management process, especially if you have dozens of employees travelling regularly.

Late reimbursement

If your company takes a long time reimbursing employee expenses, it may majorly affect employee trust and make them avoid corporate travel altogether. Whether your manual expense approval takes a while, or employees themselves take a long time filling in reports, find the bottlenecks in your system and implement automation, or update your policies to ensure that both sides can easily manage expenses after the trip.

2. Consider your technology needs

At this juncture, determine what your requirements are, and the type of solution that will fit your unique requirements best and what those requirements are. Answer these questions to outline your current situation and help a vendor pick up a solution for you:

- How many employees do you have and how many of them regularly travel?

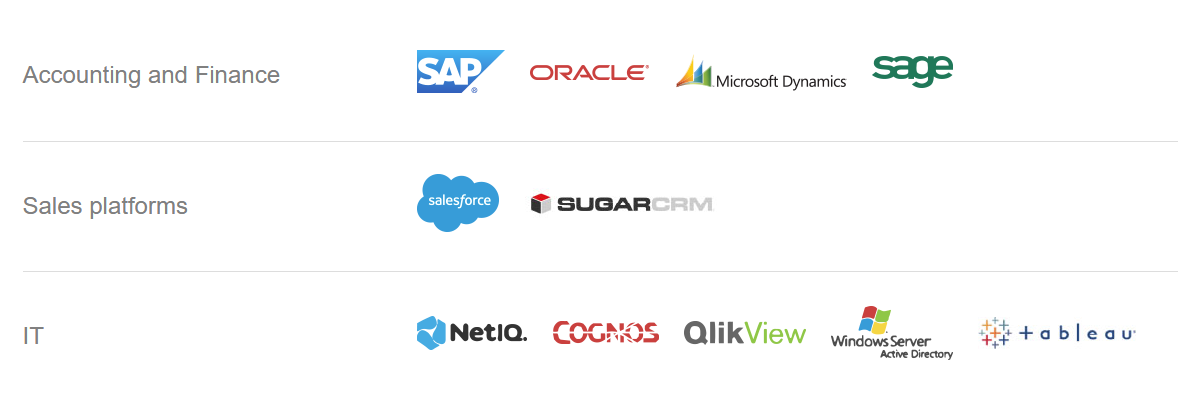

- What other services would you like to integrate with a TEM solution?

A line-up of possible integrations for a T&E software provider Captio

- Who will be managing your TEM efforts and do they need training?

- How tech-savvy are your employees? How receptive are they to revolutionary changes?

- Do you want to allow employees to book on their own? Are they willing to have more freedom during corporate trips?

3. Consider your budget opportunities

The price you pay for setup, integration, support, customization and, of course, the product itself depends heavily on what type of solution you’re ready to invest in. We can distinguish three possible solutions: on-premise, Software-as-a-Service (SaaS), and custom implementation.

On-premise software is usually more expensive as you pay upfront for everything that comes with a product. This includes additional hardware and software required to run this application. Also, since your provider may reside in a different place, even a different country, all setup and integration could be executed on your part, by your own IT department. Customization capabilities are also often limited and expensive.

SaaS is a common solution that allows companies to start using software almost instantly. The payment conditions are also budget-friendly. You pay per user and as you go, meaning that both small and large companies can confidently scale. When it comes to integrations and customization, it differs. Often, you’ll have to search for a solution that has your exact package of allowed integrations, and customization – although allowed – often is your problem.

Custom implementation is a solution where you hire a vendor to do all the hard work for you. The custom option allows you to wire any popular T&E software to your needs. Along with an implementation partner, you’ll discuss your personal configurations, requests, and expectations. For instance, if you want your expense reports or invoices to be automatically sent to an employee’s email, a vendor will help you build a custom program for that. They will also be able to work on-site, meaning in your own office to augment your IT team. This way, you’ll have more than what a TEM provider offers and can streamline your operations instead of adjusting to pre-established processes.

4. Gather employee feedback

Traveler, financial department, IT, top management, all will be involved in company travel expense management. You need to understand their work processes, address their questions, and remove inconvenience decisions with this new product. Ask your employees directly how they currently keep track of expenses and what they’d like to see improved. Travel agents will tell you what slows the approval and reimbursement process down the most and what can help avoid these bottlenecks. Your CFO will help you understand what organization data is being analyzed and what kind of reports the company is lacking.

5. Assess your current cloud infrastructure

You’re most likely already using some type of cloud technology to manage your organization. Typically, the biggest concern about using new cloud systems is how to integrate them with internal processes and other cloud services. So, first assess what connections you can make and how to open a newly integrated software is to more linkage in the future. Usually, T&E solutions thoroughly describe how they plan to sync up your data, how long integration will take, and what system requirements the software has. For example, Concur has its own App Center where you can browse through apps and services that can be linked to their solutions.

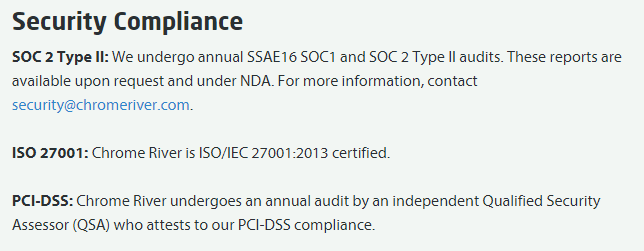

6. Assess a provider’s security profile

What are you doing to make your organization’s data secure? And how does a vendor store your sensitive data in the cloud? Though public cloud services allow you to scale more easily and reduce costs, there’s almost no guarantee this data will be stored safely. Be prepared for what the loss of this data will mean for your organization and people who work in it. The easiest way to check a vendor’s security profile is by reviewing certifications, accreditations, and standards. The best practice information security standard is ISO27001 and with GDPR approaching, it’s the safest sign that an organization is managing data protection responsibly.

ChromeRiver has a page dedicated to data security standards compliance

7. Prepare for legacy data storing

Migrating your old Excel spreadsheets to a new T&E system will take considerable time and labour, especially with respect to the amount of preparation and adjustment you’ll have to make. However, you should still store legacy data accurately. That way, when access is required, data can be easily retrieved and interpreted. If you’re planning to use historical data for reporting and predictions, finish analysis before migration.

8. Prepare for remote technical implementation

Using a cloud service means that all setup, implementation, and technical support will be managed remotely. When searching for a software provider, make sure they have a professional approach to remote project management, comprehensive guidelines, and FAQs that will help you deal with technical issues on your own. Coupa, for instance, has virtual workshops and training courses, allowing their clients to share best practices and ask questions.

In Conclusion

If you don’t have a well-oiled mechanism to manage your travel expenses, you have no way of knowing if your expenses are normal or not. When you have information only about one point in time, how do you compare expenses of employees from the same and different levels? How do you engage them to manage their travel activities responsibly if they don’t know your reimbursement policy? How do you know if your organization and personal employee data are safe when they’re using unapproved consumer-faced tools?

Organizing travel and expense management is beneficial for both sides. Travellers don’t feel as lost and confused when they have a strict policy and clear communication. Agents can be occupied with more creative and challenging tasks by automating routine ones. It’s for you to decide what change your company requires and how to achieve it. Either way, this change will undoubtedly bring cost savings, performance improvements, and a more transparent relationship within your company.