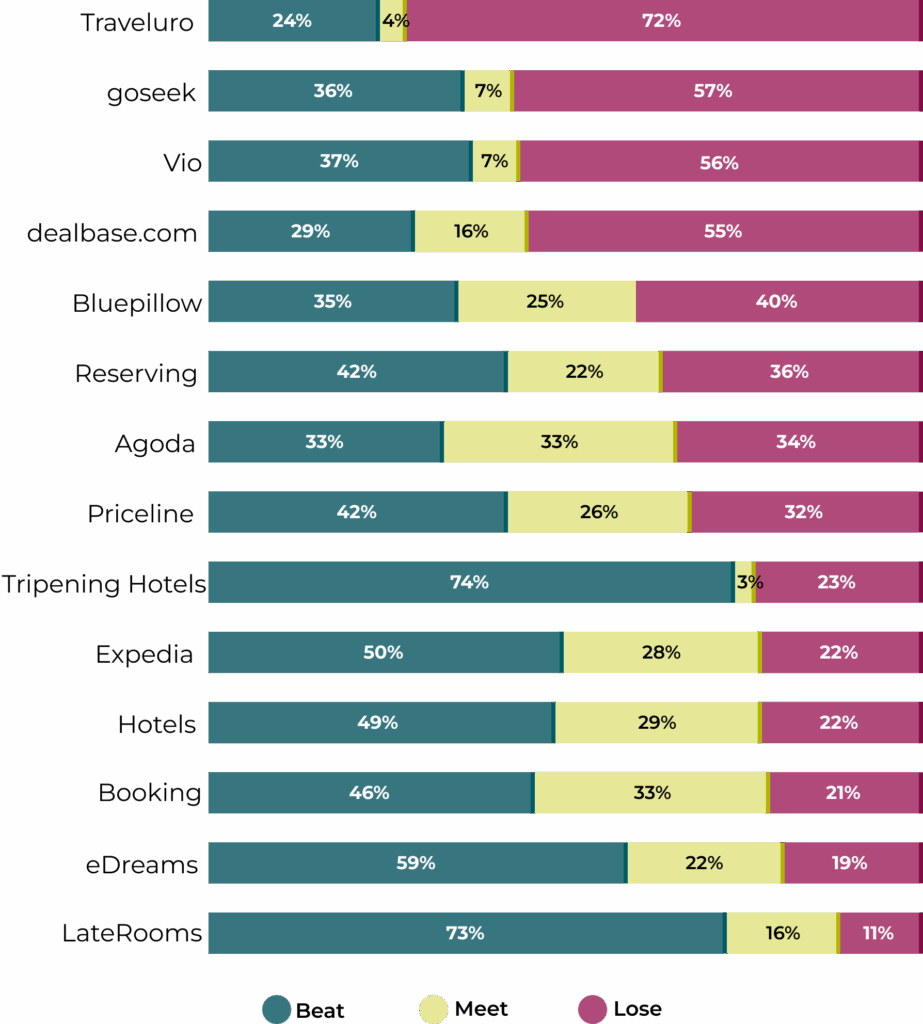

April’s World Parity Monitor from 123Compare reveals the relationship between price positioning and OTA aggressiveness.

As hotels continue to refine their revenue strategies, 123Compare.me unveils the findings from the latest edition of its World Parity Monitor (WPM) exploring how a hotel’s price position relative to its local market average affects OTA pricing behaviour and rate parity.

The April report has identified that when hotel rates are priced above the market average, the Lose rate — the percentage of times a hotel’s direct price is undercut by an OTA — increases significantly, especially for independent properties. Non-major OTAs show the most aggressive pricing responses, underscoring the risks of overpricing in competitive environments.

Across the sample*, 75% of hotels were undercut by at least one OTA, and Expedia surpassed the 20% Lose rate threshold, reversing its recent trend of moderation.

From January to April 2025, direct prices rose steadily and ended 6.3% higher than in the same period of 2024 — continuing the upward trajectory already observed last year. This trend reflects a structural pattern, where direct rates start low early in the year and peak around spring, particularly influenced by seasonal events like Easter.

Notably, price positioning matters more than ever. While major OTAs like Booking and Expedia maintained stable Lose rates regardless of price segment, non-major OTAs became more aggressive as hotel prices rose. Meanwhile, the direct channel remained more competitive in lower-price segments and saw improved Meet rates at mid-range levels.

“Being just slightly above the average can trigger aggressive responses from OTAs,” says Jordi Serra, CEO at 123Compare.me. “Hotels — especially independents — need to keep a close eye on how their positioning aligns with market trends.”

“If I’m an independent hotel and my price is above the market average, I should be concerned about OTAs becoming more aggressive and undercutting my rates. This is a very clear pattern we are seeing month after month.”

The WPM also confirms that independent hotels are more vulnerable to parity loss. When priced more than 40% above the market average, the Lose rate reached 41.8% with non-major OTAs, compared to 34.0% with major OTAs.

The World Parity Monitor is a reference in the market and a tool to track and monitor hotel pricing strategies across distribution channels.

The World Parity Monitor is the first price parity center for the hospitality industry, created by 123Compare.me. It provides insights into price disparity trends across 3-, 4-, and 5-star hotels in the world’s 60 most important tourist destinations.

Each month, it analyzes over 5 million comparisons in Google Hotels, using a consistent sample of more than 6,000 hotels. This enables a reliable evaluation of price differences between hotels’ direct rates and OTA prices.

The WPM includes data segmented by occupancy levels, length of stay, and booking lead time. On the first month of each quarter, the analysis is extended to include country of origin, mobile usage, and family bookings. Month-to-month comparisons use consistent metrics to ensure reliability.

Within the framework of the World Parity Monitor, the monthly World Parity Reports are focused digests of the latest pricing behaviors and trends.

Methodology: Key Performance Indicators (KPIs)

- Beat: The hotel’s direct price is lower than OTA prices.

- Meet: The direct and OTA prices are the same or within +/- 0.5%.

- Lose: The OTA price is lower than the direct rate.